Effortless Payments, Guaranteed Security,Reliable Payment Gateway For Your Busines Needs. Enhance Your High Risk Business With Our Payment Gateways Services In India.

Get StartedLet Us Help You With

Secure Payment

|

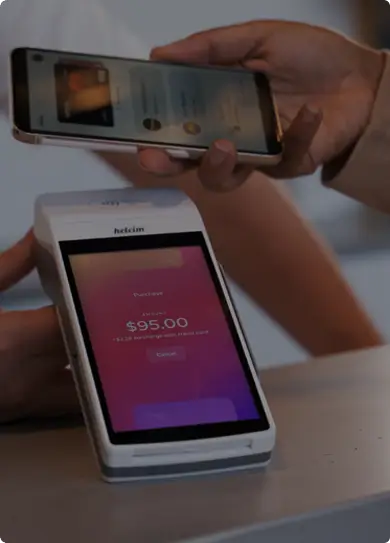

Faster Checkout Process Faster checkout process can be achieved by simplifying the checkout steps, offering a guest checkout option, providing multiple payment options, and using a payment gateway that integrates with your High Risk platform. |

|

Reach Global Customers Payment Gateways allow you to accept payments from customers all over the world, no matter where your business is located. |

|

Say Goodbye To Fraud Payments Reach non-credit customers or markets with low credit card adoption through alternate payments.Win-win for you and your customers. |

Secure APIs Secure APIs are essential forPayment Gatewaysto protect sensitive payment information and ensure that only authorized users can access and interact with their systems. |

Data Security

Confidential information such as credit card details and personal data is protected from unauthorized access and fraudulent activities.

Support

Product info and 24/7 team supuport.

Payment Seurity

Solutions that protect every transaction.

Our Partnerships

Integrated B2B software solutions.

Multi-Payment Acceptance

Debit card and credit card, UPI, Gpay, PhonePay.

Multi-Currency

Display and charge customers for goods and services in their home currency.

CricPayZ Services

Payment gateways services go beyond simply processing payments, and can include features such as fraud prevention, data security, and customer support. Here are some of the key services that a payment gateway may offer

Payment Processing

The primary service offered by a payment gateways is payment processing, which involves securely processing and authorizing transactions made by customers using various payment methods.

Payment Methods

Payment Gateway offer various payment methods to businesses, including credit and debit cards, net banking, UPI, and mobile wallets. This allows businesses to cater to the payment preferences of their customers.

Integration

Payment Gateways offer APIs and Iframe that allow businesses to integrate their existing systems with the payment gateways, ensuring seamless data transfer and synchronization.

Customer Support

Payment gateways offer customer support to assist businesses with any issues or questions they may have. This support may be offered through email.

High Risk Payment Gateway

Secure Payment Gateway Solutions For High-Risk Transactions

Cricpayz.io is a payment gateway that is designed to facilitate High-Risk transactions in India. It is specifically tailored to meet the needs of businesses operating in Forex, Sportsbetting, and Online Casino Industries. The payment gateway accepts various payment methods such as GPay, PhonePe, NEFT, UPI, Visa, Paytm, and many more.

Cricpayz.io is a reliable and secure payment gateway that prioritizes the safety and convenience of its users. It operates with a quick and streamlined processing system that facilitates speedy transactions. Additionally, the payment gateway supports Forex transactions that allow businesses to send and receive international payments quickly and efficiently.

Yes, if you operate an online gambling business, you will likely need a High-Risk payment gateway.The online gambling industry is considered High-Risk due to its high potential for chargebacks and fraud, as well as legal and regulatory complexities in many jurisdictions.

Whether or not you need a High-Risk payment gateway depends on the nature of your business and the level of risk associated with your industry. High risk payment gateways are typically required for businesses that operate in industries with a higher likelihood of chargebacks or fraud, such as online gambling, entertainment, or High Risk businesses that sell high-ticket items.

If your business operates in a High-Risk industry, then you will likely need a High-Risk payment gateway to ensure that your transactions are secure and to minimize the Risk of Fraud or chargebacks. A High-Risk payment gateway will have more advanced security features, such as fraud detection and chargeback prevention tools, to both you and your customers.

For businesses operating in High-Risk industries, the payment situation can be challenging. Such businesses face increased risks of chargebacks, fraud, and payment disputes, which can result in significant financial losses. Tackling the payments situation in High-Risk scenarios requires a strategic approach that prioritizes security, compliance, and risk mitigation.

Partner with us

Revolutionize Payments, Partner with Cricpayz - Your Gateway to Seamless Transactions!

Partner with

Join Us on the Journey to Success: Become a Partner Today! Partner with cricpayz, the leading payment service provider, and take your business to the next level. Our partnership program offers lucrative opportunities to grow your revenue and expand your customer base.

Interested in partnering with cricpayz.io? We believe that collaboration is the key to success, and we're excited to work with individuals and businesses who share our vision. Contact us today to see how we can help you.

Partner With UsHow it works

Take these three simple steps and become our partner!

Partner with us

Partnering with cricpayz.io is simple and straightforward. Our team of experts wil work with you every step of the way to ensure a smooth integration and a successful partnership. Sign up for partnership today and start enjoying all the benefits of cricpayz.io.

We'll be in touch with you

By partnering with us, you can offer your customers a seamless payment experience that will keep them coming back for more. Integrating our payment platform into your website is quick and easy and will provide you with access to a wide range of payment options.

Let's get started

Let us handle the technical aspects of payment processing, so you can focus on what you do best - growing your business. start accepting payments without any hassle or stress. With our easy-to-use interface and top-notch security, you can be sure that your customers information is safe and secure.